News Release

| << Back | ||||||

GWG Holdings Survey Finds Advisors Gain Clients While Investors Seek Counsel Beyond Investment Returns During COVID-19 Pandemic

July 16, 2020 at 4:30 PM EDT

|

||||||

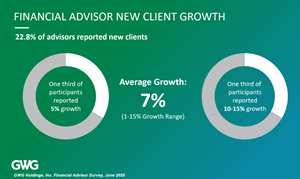

More than one-fifth of the surveyed advisors reported gaining new clients during the pandemic, with one-third of those respondents reporting more than 10 percent client growth as clients sought reassurance while markets grew increasingly volatile. “The results of our survey show the critical function advisors perform for our society. All people need financial advice in attaining personal security, particularly in times of stress,” said GWGH Chief Executive Officer GWGH, a GWGH surveyed 128 advisors across the The surveyed advisors described having to deal with the daunting needs of clients who were concerned about their investments, their health, and the possibility of job and income loss. More than 40 percent said they had to manage their own personal health and business concerns while serving concerned clients. Close to 60 percent of respondents said, their biggest challenge was balancing the need to reassure clients while providing investing strategies like rebalancing to them. Right behind that challenge was the need to communicate relevant information in the rapidly changing environment. Top client concerns included the markets in general and their current investments, but almost four in ten reported client worries about heath, jobs, and income. “Advisors are acting as personal counselors for those clients who were frightened by the initial deep declines in the market,” said The survey found that technology has become a growing element of communication with clients. About 13 percent of advisors reported conducting video chats with clients and 81.2 percent of those used Zoom as their method of communicating. Three-quarters of advisors who responded said they found it as easy or easier to connect with clients during the pandemic. Of course, traditional means have held their own: 73 percent said they successfully interacted with clients by telephone. Technology has become standard practice for many advisors. Only 10 percent of respondents said technology was too complex or inconvenient for them or their staffs. One long-term impact of the pandemic may be the ability to work from home. Almost 20 percent of respondents said they expect to continue working remotely or from a home office after the pandemic has ended. About For more information about Media Contact: A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3233cd7b-7751-414c-bba1-60cf56bed4a0 Source: GWG Holdings, Inc. |

||||||